Advanced Risk Control Features

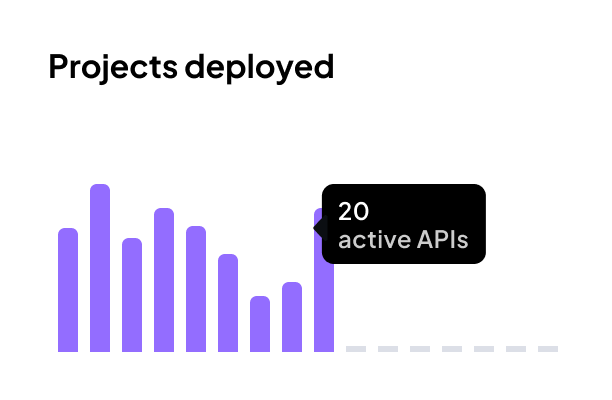

Track exposure across symbols, clients, and groups with live dashboards to manage risk before it escalates.

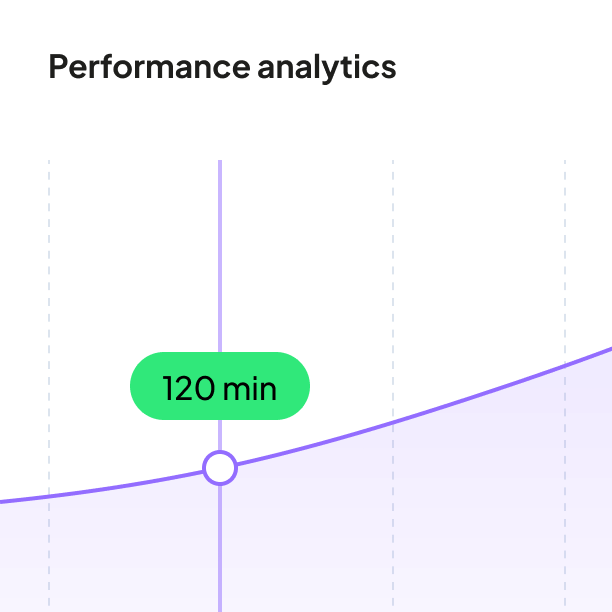

Set thresholds and receive instant alerts for margin breaches, abnormal volumes, or sudden volatility.

Apply risk parameters based on client categories — such as leverage limits, order sizes, and trade restrictions.

Gain full visibility and control over open trades, execution flow, and potential losses — all from a centralized console.

Route trades dynamically based on risk profiles, allowing for hybrid execution models (A/B book) and profit optimization.

Seamlessly integrates with your trading platform and CRM for unified oversight and decision-making.

Track client exposure, trade volumes, and market movements as they happen — across all accounts and instruments.

Set dynamic rules to trigger alerts, auto-liquidations, or trade limits when risk thresholds are breached.

Apply margin, leverage, and execution logic by account group to align with your brokerage’s risk profile.

Elite FX Technology offers high-speed, secure hosting and custom-built websites specifically for Forex brokers — helping you build trust, attract clients, and scale smoothly.

Legal Disclaimer – Elite FX Technology

“Elite FX Technology” and its associated logo are registered trademarks under applicable law. Elite FX Technology is a contractual alliance composed of multiple legal entities and professionals (collectively referred to as “Elite FX Technology”), formed to better serve our global clientele and enhance the development of the Forex and fintech sectors. Products and services described on this website may be delivered by our affiliated companies, partners, or agents in compliance with regional regulations and specific contractual terms. For information about any particular service or the entity responsible for its delivery, please contact our sales or legal team.

Elite FX Technology does not guarantee the accuracy, completeness, or currency of the content on this website and assumes no obligation to update any material. We do not warrant that the website will be uninterrupted or error-free, or that it will meet user expectations. While we take strong cybersecurity measures, we cannot ensure that our website or its content is free from viruses or harmful components. Users are solely responsible for implementing sufficient data protection and antivirus measures.

Neither Elite FX Technology, nor any party involved in the development, hosting, or delivery of this website, including its affiliates, is liable for any direct, indirect, incidental, or consequential damages arising from the use or inability to use this website or any content linked to it. This includes, but is not limited to, damages for loss of income, profit, reputation, contracts, data, or other intangible losses, regardless of the form of action (contract, tort, negligence, etc.).

All content, structure, and information presented on this website are the property of Elite FX Technology or its licensors and are protected under international copyright laws. You may download or print materials strictly for personal use. Any modification, reproduction, or redistribution of site content without prior written permission from Elite FX Technology is strictly prohibited. Embedding or linking to this site without authorization is not allowed.

Please review the legal documents available on this site below:

These documents are provided in English only. By using this website, you confirm that you understand English sufficiently or have engaged a qualified interpreter to understand these terms and their legal implications.

The information on this site is intended for general informational purposes only and does not constitute an offer or solicitation to buy or sell any financial instruments or services in any jurisdiction. Any potential offerings or services will be subject to Elite FX Technology’s internal compliance policies, legal review, and may change without notice. None of the content provided constitutes investment advice or legal counsel. The use of financial or digital products inherently carries risk. Elite FX Technology and its affiliates are not responsible for any financial loss, damages, or disruptions related to the use of this website or its services.

By continuing to use this website, you confirm your acceptance of these terms and acknowledge the legal documents provided herein.

Note: All third-party names, logos, and trademarks appearing on this website are the property of their respective owners. Elite FX Technology is not affiliated with, nor does it endorse, these third parties unless explicitly stated.

AML Policy | Disclaimer | Privacy Policy